Immediate Release

June 30, 2021

Martin County Total Market Value Increases by More Than $2 Billion

Stuart, FL – With 2021 tax roll figures in today, the Martin County Property Appraiser’s Office announced that the County saw an increase in total market value to more than $36 billion. This is an increase of more than $2.1 billion or 6.42% as compared to last year’s figure of $34 billion. Taxable value increased more than $1.2 billion or 5.27% as compared to last year’s figure of $23.8 billion. Reported values are based on market conditions as of January 1, 2021.

Residential properties experienced one of the largest growth years since 2006 with 7.89% increase over last year. The median sale price of single-family homes increased to $388,945 compared to $365,000 in 2019. Median condominium sale prices increased to $168,500 compared to $148,750 in 2019.

“This year’s residential market value growth may be attributed to the overwhelming amount of demand which has far outpaced local supply,” said Martin County Property Appraiser Jenny Fields. “Listing times have shrunk significantly, properties are receiving offers above asking prices, and many properties are being purchased sight unseen. Home buyers are relocating to Martin County from out of state and highly populated counties in Florida.”

Commercial and industrial properties logged another year of growth this year with a 5.9% increase compared to last year.

“Net new construction growth was $297 million this year which is comparable to the past three years,” said Fields. “We are however, seeing many multi- family projects in the pipeline that may finish construction this year and will go on the 2022 tax roll.”

Fields and her team of professionals certified the 2021 Preliminary Tax Roll to the Florida Department of Revenue (DOR) on Friday, June 25. This is the earliest the Office has ever submitted preliminary numbers to the DOR. A deadline is set for July 1 each year for all property appraisers’ offices throughout the State to submit their values. The early tax roll submission was a result of a multi-year conversion project to upgrade the software used for appraisal and assessment administration. The new system is already creating efficiencies by reducing the time to run and validate technical tax roll reports.

Taxing authorities will use these values next to help them prepare for their upcoming budgets and to determine their proposed millage rates.

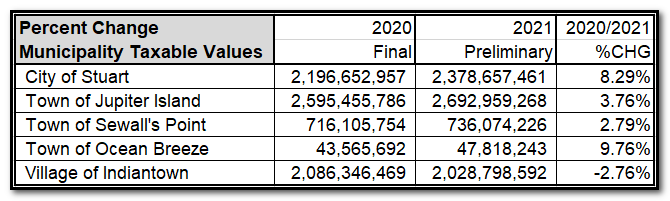

Taxable Values for all Municipalities

Founded in 1925, The Martin County Property Appraiser’s Office (MCPAO) is one of 67 county appraisal offices in the State of Florida. Governed by the Department of Revenue, the MCPAO values more than 100,000 real, commercial, industrial and tangible personal properties throughout the County for a total of 543.46 land area square miles. The MCPAO is one of 52 offices in the United States and Canada to receive the prestigious Certificate of Excellence in Assessment Administration from the International Association of Assessing Officers.

-30-

![]() Martin County History of Total Market Value.pdf

Martin County History of Total Market Value.pdf

![]() Martin County Residential Median Sales.pdf

Martin County Residential Median Sales.pdf